Features

Credit Adjudication

Process deals faster

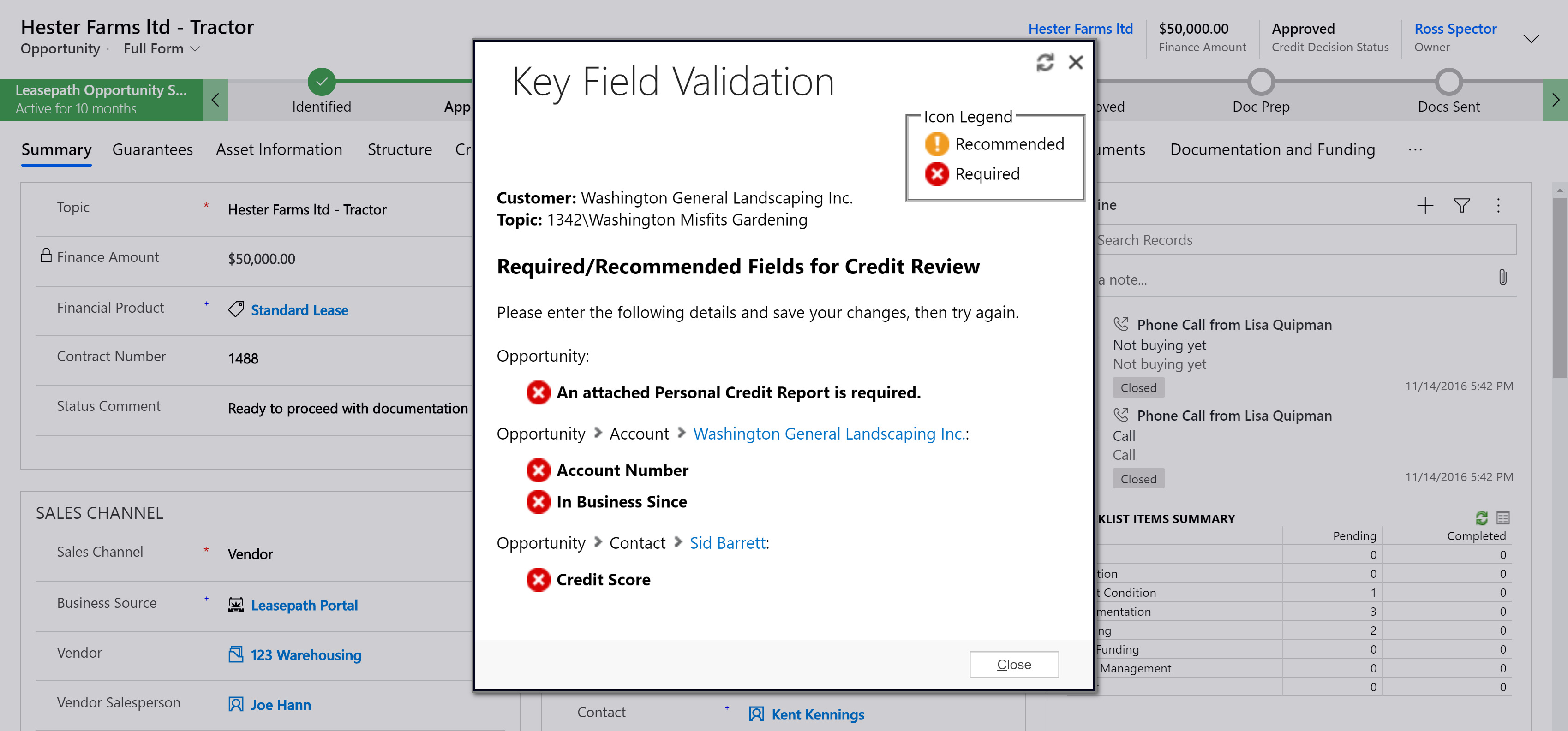

Leasepath Credit Adjudication streamlines credit review, increasing speed and efficiency without sacrificing compliance and quality decision-making. Leasepath will allow you to set required documents and information prior to submitting a deal to credit, which will reduce the need for credit to chase down information or documents.

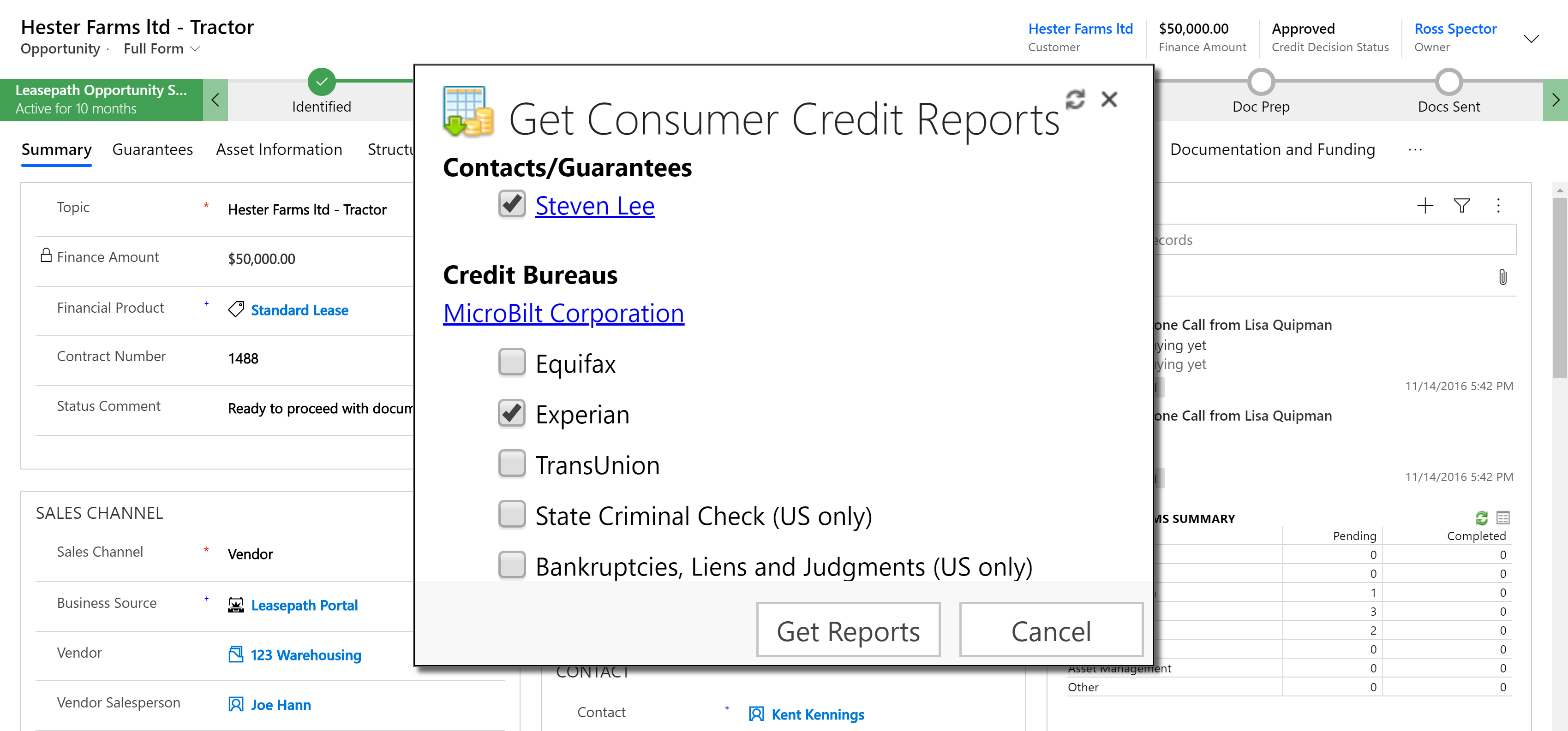

Make smarter and faster credit decisions

Leasepath provides access to more data with less effort, such as personal and business credit bureaus available to be pulled at the click of a button. With all necessary data and reports in one place, credit users can make more informed decisions in less time. Leasepath enforces internal policies related to exposure and credit approval limitations, providing simple oversight.

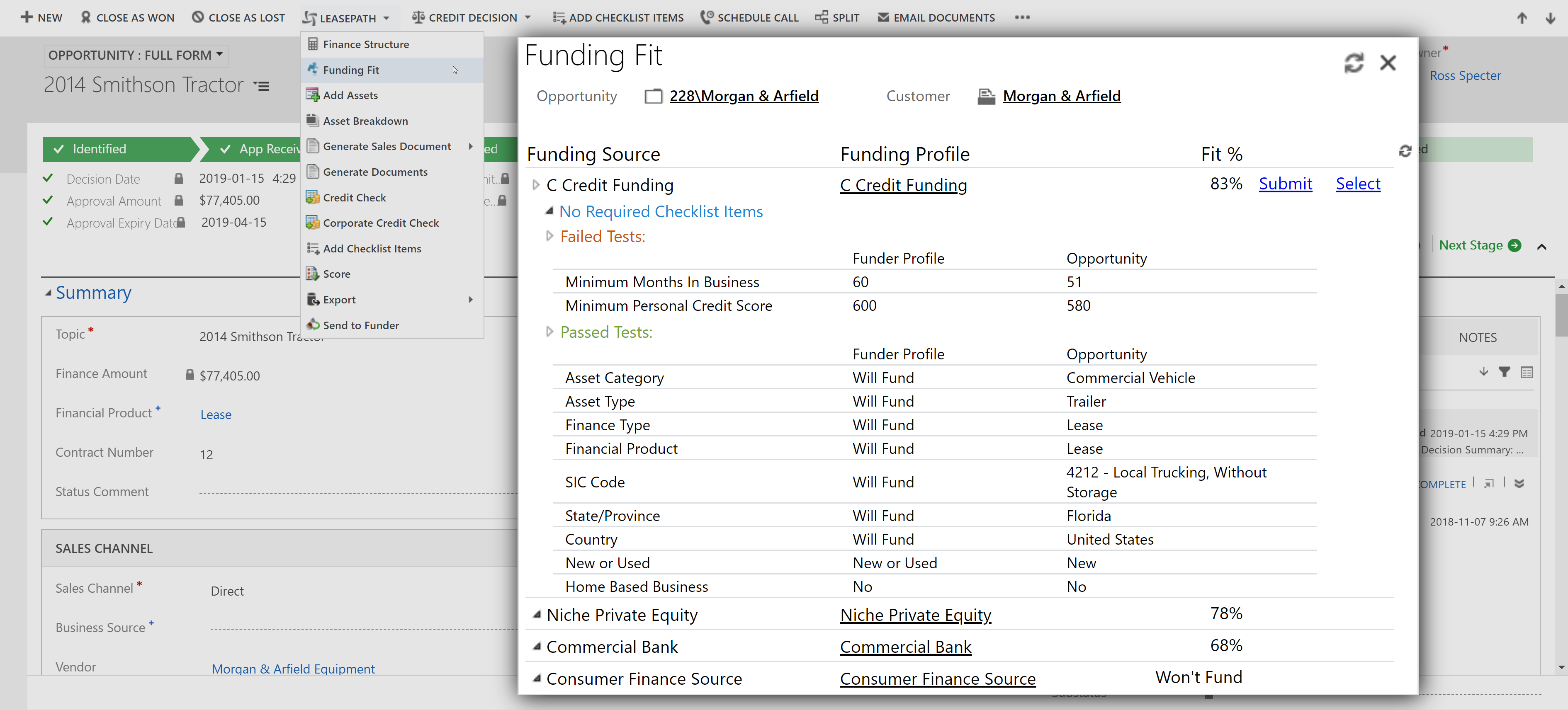

Match applications to the best source of funds

Leasepath allows you to manage funding sources and portfolios. You can configure Funding Profiles for both your internal funding portfolios or external funding sources and use our Funder Fit feature to determine the best source or portfolio for each deal, saving your staff valuable time on each deal.