Features

Loan Origination Process Automation

Do more with less

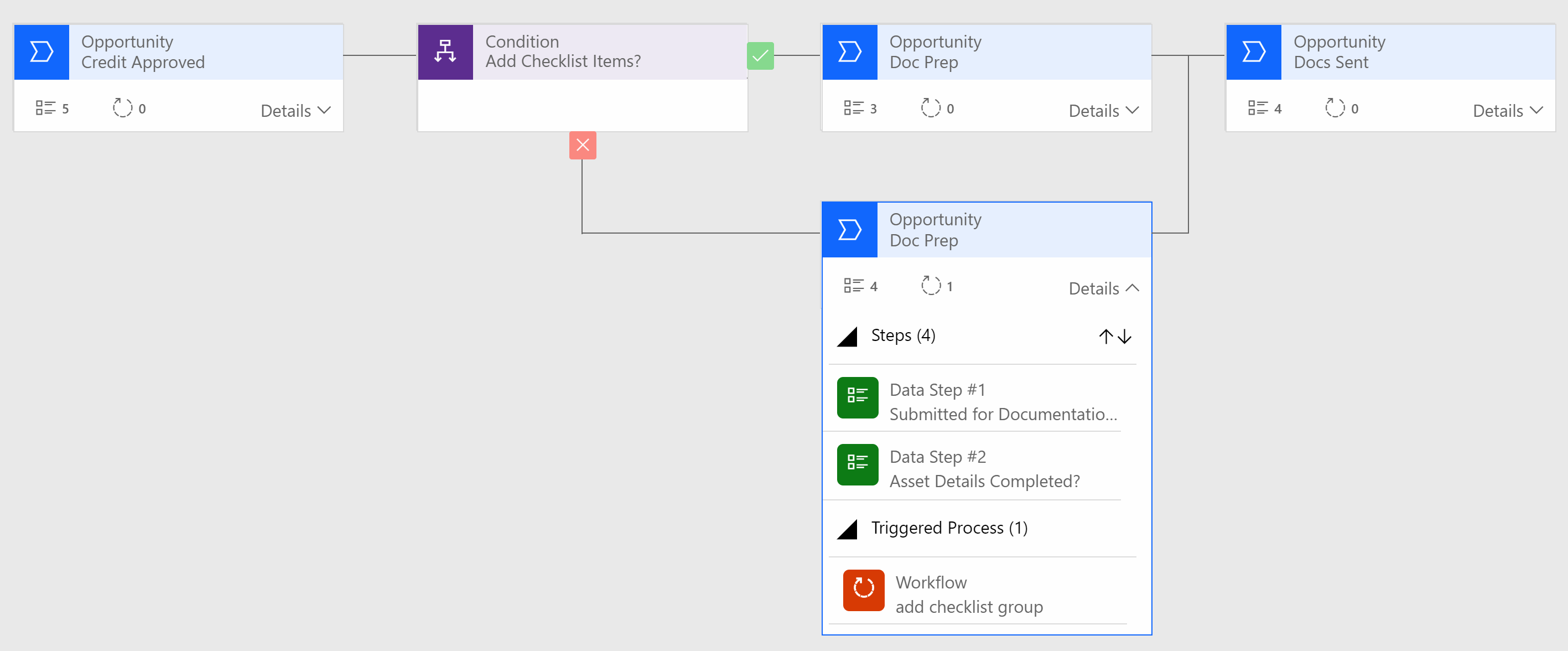

Leasepath’s robust loan origination process automation can maximize an organization’s efficiency, generating more revenue with existing staff and resources. Out-of-the-box workflows offer immediate access to email notifications, task creation and checklist generation.

In addition to out-of-the-box workflows, you can create your own workflows to notify users, create tasks, or modify data based on your own criteria. This will ensure that deals are always moving forward.

A system that fits your company

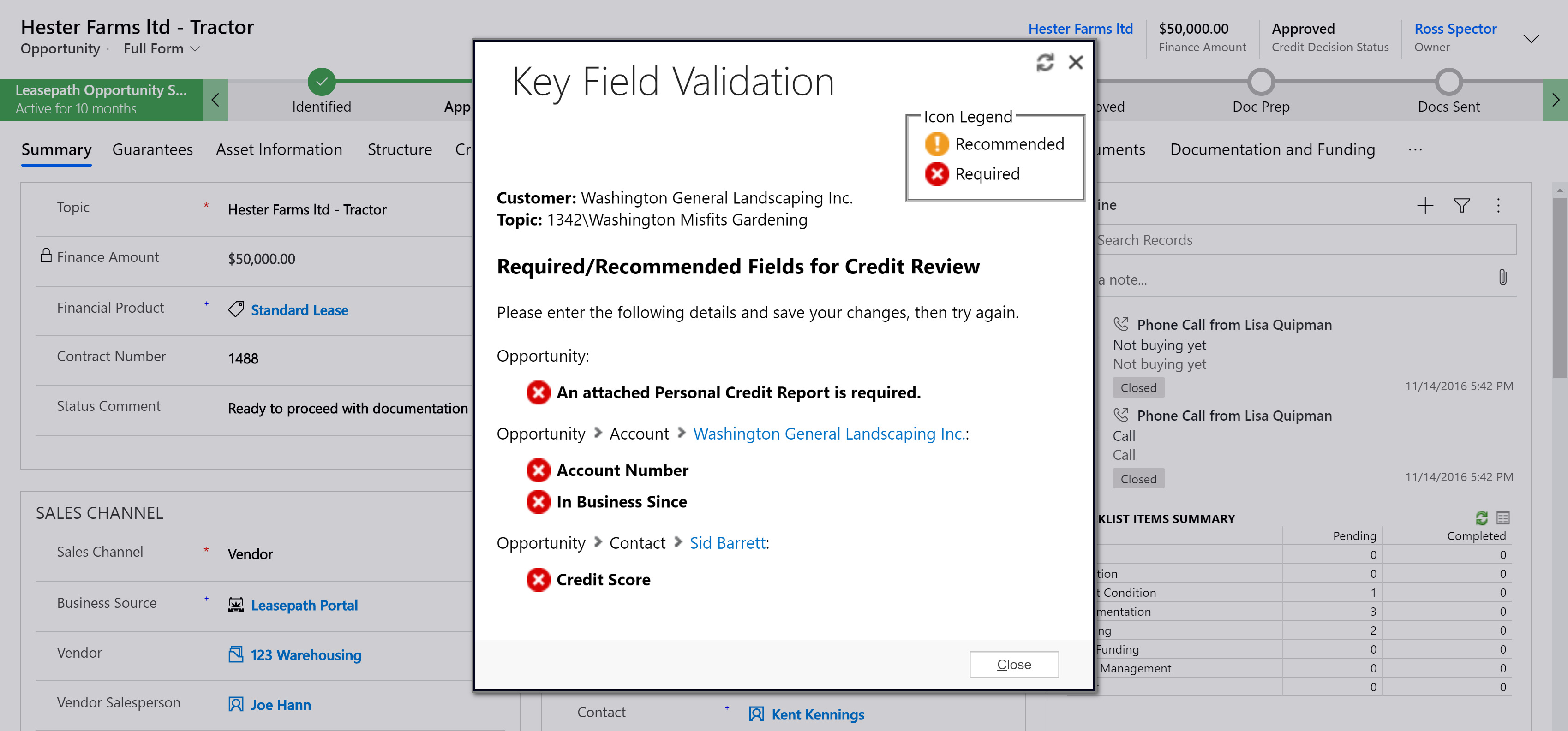

Your own custom business process flow can be mapped into Leasepath. This allows you to decide exactly what information must be entered and what actions must be taken prior to a deal advancing. This will reduce the need to scramble back and forth collecting the necessary information to proceed with a deal’s next steps.

Configurable pop-up reminders can inform your staff of exactly what information is required, so that there is no confusion as to what they need to do next.

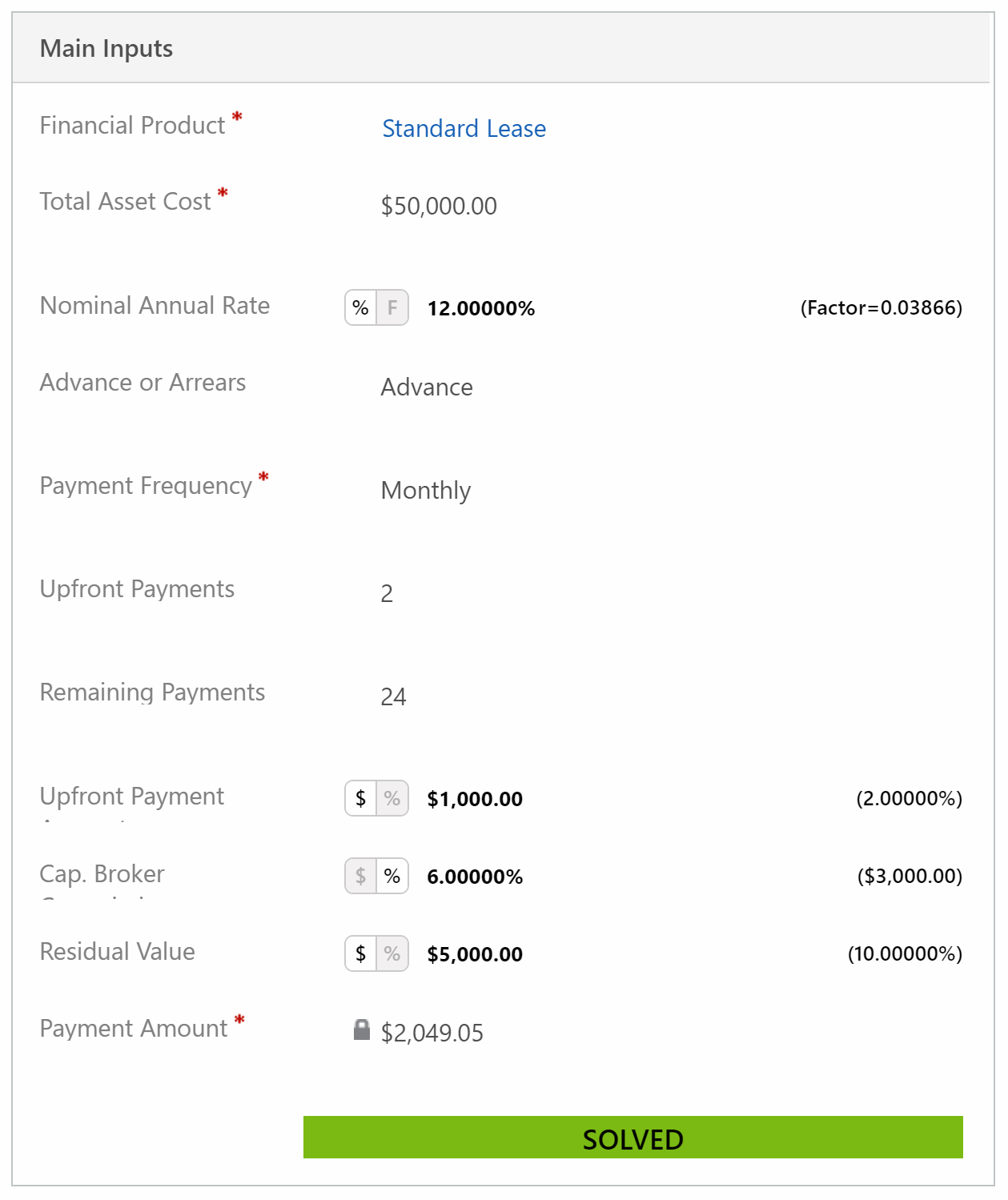

Quick and reliable quotes

Leasepath offers a powerful finance structure tool, built on the TValue Engine. This allows users to calculate rates and payments for deals in progress directly within the system.

Multiple configurable financial products scan be fine-tuned to your offerings, choosing settings such as commissions, residual value and upfront payments. Internal funding, brokering, and discounting are all supported by Leasepath’s financial calculator.